The Dirty Truth About Clean Energy: Why Smart Money is Betting on the Chaos

Everyone wants to tell you that oil is dead and solar is the savior, or that renewables are a scam and drill-baby-drill is the only way forward. Both sides are lying to you. If you look at the actual numbers - not the headlines, but the raw data coming out of the global markets - you see a very different story unfolding. It isn't a clean transition; it is a messy, volatile, and highly profitable collision of two worlds. The energy sector has become the single most accurate wealth indicator we have right now, yet most people are still reading yesterday's news. If you want to understand where the economy is actually going, you have to stop listening to the politicians and start watching the barrels and the batteries.

The Great Energy Paradox (Or Why Prices Make No Sense)

Here is the thing about the energy market right now. It is schizophrenic. You have the International Energy Agency (IEA) saying demand for fossil fuels will peak before 2030¹. That sounds great on paper. But then you look at the daily consumption numbers, and they are hitting record highs. It doesn't add up.

This disconnect creates what traders call a "volatility trap."

You see, while the world is busy shouting about the renewable energy transition, the underlying infrastructure for oil and gas is being starved of capital. Investors are scared to put money into long-term drilling projects because they are told oil is going away. So, supply tightens. And when supply tightens but demand stays robust (because, let's be honest, the world still runs on diesel), prices spike. It is Economics 101. But it feels like a crisis.

Consider the data. Global oil demand is still pushing past 100 million barrels per day². That is a lot of oil. Yet, investment in new production is lagging significantly behind what is needed to maintain that flow. The result? Price swings that wipe out amateur investors who think the market moves in a straight line. The gap between "projected" decline and "actual" usage is where the money is lost - or made.

And don't get me started on the grid.

The renewable side has its own mess. Solar and wind are cheaper than ever to generate - true - but they are expensive to integrate. You can't just plug a massive solar farm into a grid designed in the 1950s. It breaks things. Literally. We are seeing curtailment (where operators have to pay to dump excess power) and blackouts happening in the same week. It is chaotic. And expensive.

Look at California as a prime example. In the middle of the day, solar output can get so high that the state sometimes has to pay neighboring Arizona to take the excess electricity just to prevent grid overload. That is negative pricing. Then, six hours later when the sun goes down, prices spike to the moon because everyone turns on their AC at once. This creates an arbitrage opportunity for battery storage that is frankly ridiculous, yet almost nobody outside the industry is talking about the specific mechanics of it. They just complain about the bills.

So, you have oil prices that refuse to crash and green energy projects that are getting bogged down in interest rate hikes and supply chain nightmares. It's a perfect storm - and a predictable one. But for the people paying attention, this chaos isn't a problem. It's an indicator.

Hedging Your Bets in a Volatile World

The old advice? Simple. Maybe too simple. If you liked growth, you bought tech. If you wanted safety, you bought utilities or oil majors. That playbook is dead. Burned.

Today, investing in energy stocks requires a barbell strategy. You can't just pick a side. If you go 100% green, you get crushed when interest rates rise (renewables are capital intensive). Interest rates act like gravity on green tech projects; when money isn't free, the physics of the deal change. If you go 100% fossil, you face long-term regulatory risk and the eventual - yes, it is coming - decline in demand.

So, what is the smart money doing? They are buying the bridge.

The "bridge" refers to the companies that are facilitating the transition rather than fighting it. This includes the major oil companies that are quietly becoming the biggest investors in wind and carbon capture. It sounds counterintuitive - buying oil to play the green transition - but look at the balance sheets. These companies have the cash flow to survive the turbulence. Pure-play renewable companies often don't. It is like buying a hybrid car; you don't throw away the gas engine until you are sure the battery can get you all the way home.

Let's look at the numbers regarding energy market volatility:

You need both. It's not about morality. It's about math. When oil prices spike, the extra cash in your portfolio from traditional energy offsets the pain you feel at the pump and the temporary dip in your growth stocks. When oil stabilizes and rates drop, your green assets fly.

Another angle? Copper.

Nobody talks enough about copper. You cannot have an EV revolution, a wind revolution, or a grid modernization without massive amounts of copper. An electric vehicle uses roughly 2.5 times more copper than a conventional car³. That demand is inelastic. It doesn't matter if the power comes from coal or fusion; the wires are made of copper. That is the safest bet in a room full of gamblers.

And it isn't just cars. Wind turbines? They are basically massive copper generators on sticks. An offshore wind farm uses tons of the stuff per megawatt. We have not discovered enough new copper deposits to meet even half of the projected 2035 demand. That supply crunch is going to make the 1970s oil crisis look like a minor inconvenience if we don't start digging yesterday. The physics of the transition demand materials we simply do not have in the ground yet.

The solution isn't to guess the winner. It's to own the casino. In this case, the casino is the infrastructure that moves the energy, regardless of where it comes from.

Where the Smart Money is Actually Moving

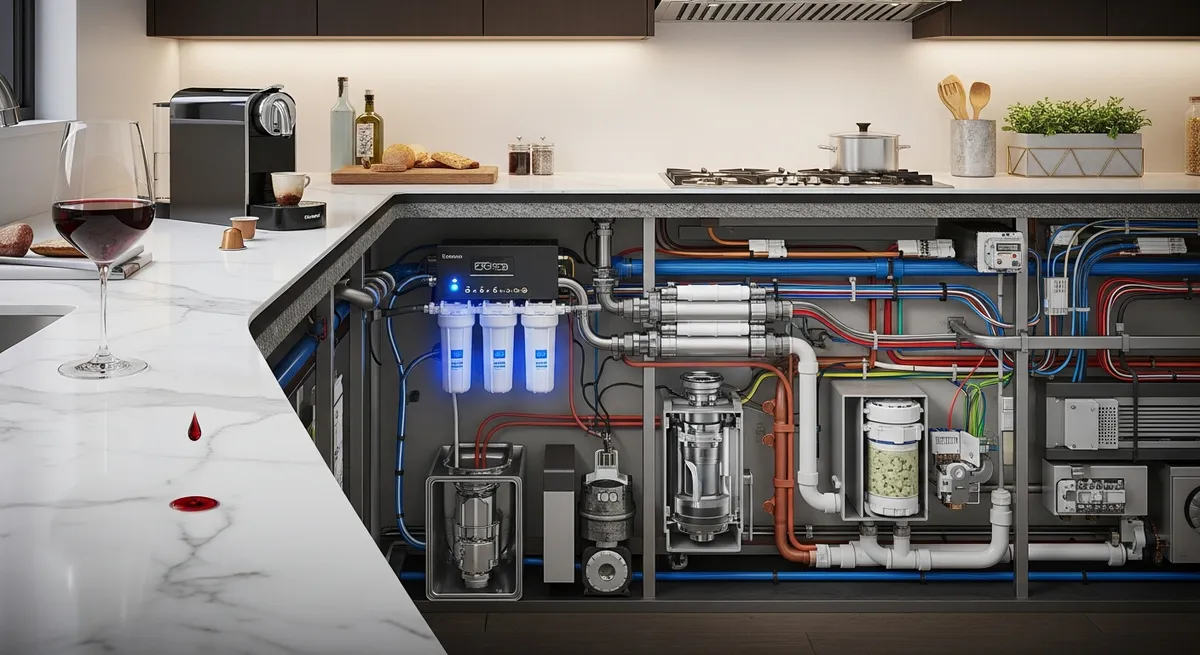

So, what do you do with this? You stop looking for the "next Tesla" and start looking for the plumbing.

The real wealth indicator in energy markets right now isn't the price of a barrel of crude; it's the capital expenditure (CapEx) trends. Companies are finally starting to spend money on "grid hardening." This is the unsexy stuff. Transformers. High-voltage cables. Storage software. We are talking about a trillion-dollar gap in infrastructure that has to be filled whether we burn coal or split atoms.

This is where the bottleneck is. And where there is a bottleneck, there is profit.

If you are looking at your portfolio and wondering why your clean energy ETFs are down 40% from their highs while Exxon is trading near record levels, this is why. The market realized that the transition is going to take decades, not years. The oil price forecast for the next five years is likely higher than the last five, simply because of underinvestment.

Here is your action plan - or at least, how I would look at it if I were trying to protect my wealth:

First, ignore the political noise. Politicians will say whatever gets votes. Markets react to physics and cash flow. Focus on companies with low debt. The era of free money is over, and renewable startups that rely on cheap loans are going to keep struggling.

Second, watch the critical minerals list. Lithium gets all the press, but it's abundant. Cobalt, nickel, and copper are where the supply crunches will happen⁴. These are the commodities that will dictate the pace of the green revolution.

Third, respect the dividend. In a volatile market, getting paid to wait is a luxury. Oil majors paying 4% or 5% yields offer a cushion that speculative green tech cannot match. It might feel dirty to some, but from a wealth preservation standpoint, it is effective.

The energy transition is happening. There is no stopping it. But it is going to be a bumpy, expensive, and chaotic ride. The people who think it's a straight line are going to lose money. The people who bet on the chaos? They might just come out ahead.

Frequently Asked Questions

Is oil really going to hit $100 a barrel again?

It's very possible - some analysts would say probable. The lack of investment in new exploration over the last five years has created a structural supply deficit. If the global economy avoids a major recession, demand will outstrip supply. We are running on thin margins.

When you combine that with geopolitical tensions in major producing regions, the risk premium comes back into play. While we might not stay at $100 forever, spikes above that level are a feature of this "messy transition," not a bug. Plan your budget accordingly.

Are electric vehicles actually cleaner given the mining involved?

This is the most common argument against EVs. The short answer is yes, but there is a "carbon debt" upfront. Manufacturing an EV battery requires mining and processing that generates more emissions initially than building a gas car. But typically - and this is the part the critics ignore - within 6 to 18 months of driving, the EV breaks even and starts having a lower total carbon footprint⁵.

The grid matters, though. If you charge that EV with coal power, the payback period takes longer. But as the grid gets greener, every EV connected to it gets cleaner automatically. It's a long game.

Should I dump my oil stocks for solar stocks?

That is usually a bad idea. As mentioned earlier, oil stocks provide cash flow and dividends that act as a stabilizer. Solar stocks are effectively high-beta growth stocks that swing wildly with interest rates. Dumping one for the other leaves you exposed.

Most institutional investors maintain exposure to both. They use the dividends from the legacy energy companies to fund positions in the growth sectors. It's about balance, not ideology.

What is "transition risk" in investing?

Transition risk is the danger that a company's assets will become "stranded" or worthless because of changes in policy or technology. For example, if a company spends billions developing a new coal mine, and then regulations ban coal use, that investment goes to zero.

That said, the knife cuts both ways. There is also a risk in moving too fast - investing in hydrogen technology, for instance, before the infrastructure is ready. Timing the transition is just as important as identifying the trend.

How do interest rates affect renewable energy projects?

Renewable energy is incredibly sensitive to interest rates. A gas plant buys fuel (an operating expense). A wind farm buys steel and turbines upfront (capital expense) and the "fuel" is free. This means wind and solar projects require huge loans to get started.

When rates went from 0% to 5%, the cost of building a new offshore wind farm skyrocketed. This is why you saw so many cancelled projects in 2023 and 2024. Until rates stabilize or subsidies increase, the green sector faces headwinds that fossil fuels don't.

References

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Energy markets are highly volatile and involve significant risk. Always consult with a qualified financial advisor before making investment decisions. The author may hold positions in the securities mentioned.