Why Fiscal Policy Analysis is the Only Crystal Ball That Actually Works (Sometimes)

Most people hear "fiscal policy analysis" and their eyes roll back into their heads. Instant coma. I get it. It sounds like something only guys in $5,000 suits worry about while screaming into phones on a trading floor.

But here is the uncomfortable reality we are facing in the 2025 economy. (And I'm not trying to scare you, just wake you up.)

The government is spending money at a rate that actually defies gravity. That spending - specifically where it goes and how much of it is printed out of thin air - directly impacts the value of the dollars in your savings account.

If you are ignoring the boring reports coming out of Washington, you are effectively flying blind in a storm. We need to look at what the numbers are really saying, not just what the politicians are promising on the 6 o'clock news.

The CBO Reports: Boring, Dense, and Terrifying

Here's the thing about the economy. It's not really about math anymore. (Was it ever? I have my doubts - big ones.) It's about psychology and politics colliding at high speed.

The Congressional Budget Office - let's just call them the CBO because life is too short for acronyms - drops these massive, dust-dry PDFs onto the internet a few times a year. Does anyone actually read them? Maybe three interns in D.C. and a hedge fund algorithm¹.

But they should. You should. Seriously.

Because buried in those 80-page documents is the roadmap. Literally. It tells you exactly how the government plans to light your money on fire. Or save it. Usually the fire thing.

When you strip away the jargon, fiscal policy analysis is just a fancy way of asking: "Is the government writing checks it can't cash?" And right now, the answer is usually... well, yeah. Obviously. But the way they are doing it matters. It acts as a distinct market signal. A flare gun going off in a dark room.

Decoding the "Table of Doom"

I call it the Table of Doom. The CBO usually labels it "Baseline Budget Projections," which sounds harmless enough. But if you scroll to page 12 (or wherever they hide it this year), you see the trajectory of interest payments on the national debt.

In 2024, the U.S. government spent more on interest payments than on defense. Let that sink in. We are spending more to service the credit card than to defend the house.

Why does this matter to your portfolio? Because when interest costs eat up the budget, the government has two choices: cut benefits (political suicide) or print more money (inflation). They almost always choose option B.

That means your cash is the victim. Understanding this table tells you - specifically - that holding 100% cash is a guaranteed way to lose purchasing power over the next decade.

Deficits as a "Buy" (or "Run") Signal

Let's get real for a second. Politics aside - I don't care who you voted for, really - spending is spending. When the government decides to inject liquidity (cash) directly into the system, it's like dumping a bucket of chum into shark-infested waters. The sharks go crazy. The market loves it. At least for a minute.

But then comes the hangover. And it's a brutal one.

I track economic indicators obsessively. It's a sickness, probably. (My spouse certainly thinks so.) And what I'm seeing lately is a disconnect that scares the hell out of me.

We have massive deficit spending happening while the economy is supposedly strong. That's like taking steroids when you're already winning the weightlifting competition. It works, sure. But eventually, your heart explodes.

The Treasury General Account: The Real Liquidity Pump

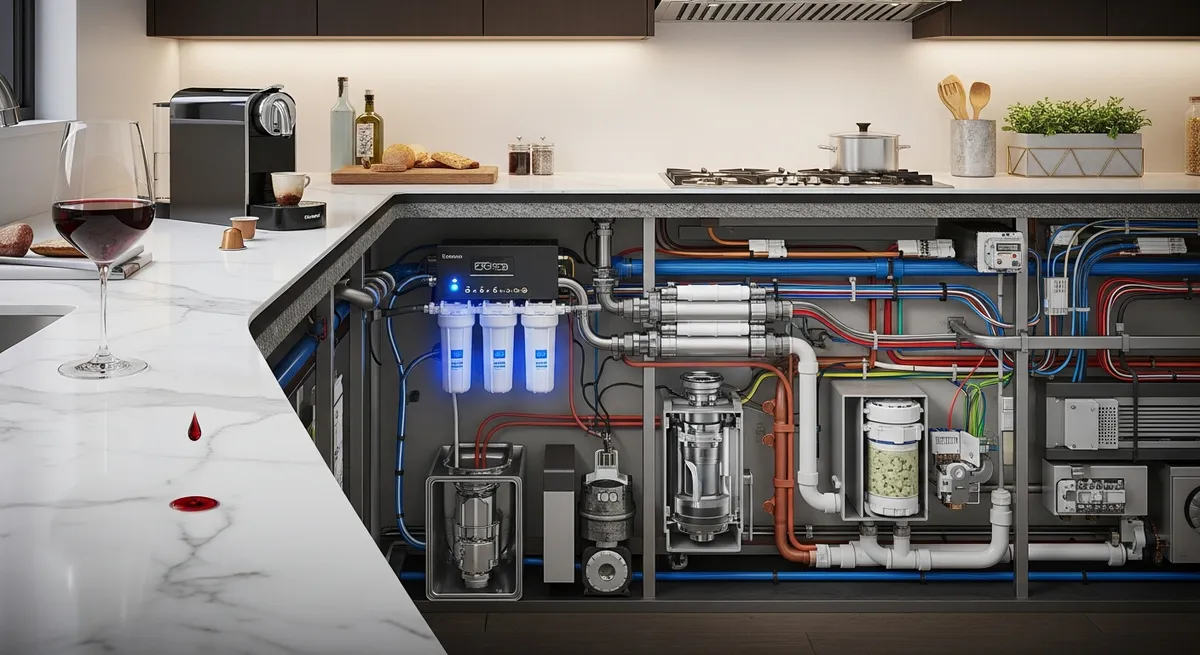

Here is a piece of plumbing nobody talks about: the Treasury General Account (TGA). Think of it as the government's checking account at the Fed.

When the TGA balance goes down, it means the government is spending cash into the economy. This usually boosts asset prices. Stocks go up. Crypto goes up. Everyone feels like a genius.

But when they need to refill that account? They have to issue bonds. They suck cash out of the system.

That is when you see liquidity dry up and markets stumble. It's a pattern we are watching closely in 2025. Watching the TGA balance is like watching the fuel gauge on a rocket. You can predict the stalls if you are paying attention.

Most people aren't. They are just watching the S&P 500 and wondering why it moved.

The government spending impact isn't instant. It creeps up on you. You feel rich because your house went up in value, but then you go to the grocery store and realize a bag of chips costs seven dollars. That's the trade-off. That's the "tax" nobody voted for.

A Quick Reality Check (The Numbers Don't Lie)

Let's look at the plumbing. Because if the pipes are leaking - and they are definitely leaking - the house is going down eventually.

See? It's not rocket science. It's just... messy. Economics is supposed to be a science, right? But when you drag politics into it, it becomes this chaotic abstract art form where the paint is money and the canvas is your 401(k)².

The Yield Curve: The Flashing Red Light

If you take one thing away from this rant - seriously, just one thing - watch the yield curve. I know, I know. "Yield curve" sounds like the most boring phrase in the English language. It sounds like something your high school econ teacher mumbled about while you slept.

But it's the only honest thing left in finance.

Yield curve signals are basically the bond market shouting at the stock market. When long-term rates spike because investors are terrified of future inflation (or default, which is a darker conversation), the curve steepens.

It's a warning. If you see the government spending trillions - with a T - while the yield curve does a vertical climb, that is a flashing red light.

Specifically for long-duration assets. Think unprofitable tech stocks. Think crypto projects with no revenue. When the yield curve screams, those things tend to get crushed. Like, specifically crushed. We saw this in late 2023 - the curve un-inverted briefly and small caps took a beating.

Financial Repression: The Silent Killer

There is a term you need to know: Financial Repression. It sounds like a conspiracy theory, but it is standard economic policy. It happens when the government keeps interest rates below the rate of inflation.

Why do they do this? To burn off their debt. If inflation is 5% and they pay you 4% on bonds, they are effectively reducing their debt burden by 1% a year at your expense.

This is why the yield curve matters so much. It tells you if the bond vigilantes are waking up. If the market demands higher rates than the government can afford, the whole system shakes. That is when the Fed usually steps in to manipulate the curve (Yield Curve Control). If you see that happening, buy hard assets. Immediately.

So, What Do We Actually Do?

Okay, enough doom and gloom. (Sorry. I have a tendency to spiral. It's an occupational hazard.) The government is the whale in the pool. We are the plankton. How do we avoid getting swallowed when the whale thrashes around?

You have to pivot. Fast.

If fiscal policy is loose (spending is high), cash is trash. I hate that rhyme - it's cheesy - but it's true. You can't sit in cash when the government is devaluing it by 4% or 5% a year. You need hard assets. Things that hurt when you drop them on your foot. Real estate, commodities, profitable companies that actually make things.

The Barbell Strategy

Here is what I actually do with my own money. (Again, not financial advice, just one guy trying not to go broke.) I use a barbell strategy.

On one end: Extreme Safety. Short-term T-bills or high-yield savings. This is for liquidity. If the market crashes, I want cash to buy the dip. I don't want to be forced to sell my house to buy groceries.

On the other end: Inflation Hedges. This is where I put the stuff that benefits from fiscal stupidity. Gold is the classic one. It hates high real rates, but it loves debasement. Real estate is another, though rates make that tricky right now. And yes, a small percentage in high-growth tech or Bitcoin - things that act as a liquidity sponge when the money printer turns on.

But - and here is the kicker - you have to watch for the pivot. If the CBO report comes out and says "We're cutting spending" (unlikely, but let's pretend), the whole game flips. Then cash becomes king again. It's a game of musical chairs, and the music is controlled by bureaucrats who haven't bought their own groceries in thirty years³.

FAQ: Reading the Tea Leaves Without Getting Burned

Is fiscal policy the same as monetary policy?

No. People mix these up constantly. (And it drives me nuts.) Fiscal policy is the government taxing and spending. It's Congress. Monetary policy is the Fed raising rates and printing money. They are like two different drivers fighting over the steering wheel of a speeding bus. Sometimes they work together. Usually, they don't. Right now, Fiscal is pressing the gas (spending) while Monetary is tapping the brakes (rates).

Can I just ignore this and buy index funds?

I mean... you can? Lots of people do. "Time in the market beats timing the market," right? That's the classic advice. But when fiscal policy gets this extreme, "set it and forget it" can turn into "set it and regret it." I'm not saying day trade. I'm saying pay attention. If the government passes a $2 trillion stimulus, maybe don't be 100% in long-term bonds. Adjust your sails, don't just drift.

Where do I find these CBO reports?

They are online. Free. Just Google "CBO Budget Outlook." Warning: they are dry. Like, Sahara dry. But the summary tables - specifically the "Baseline Projections" - are gold mines if you know what you're looking at. Or, you know, find a nerd who reads them for you (like me) and subscribe to their newsletter.

Does the deficit actually matter if we print our own money?

This is the Modern Monetary Theory (MMT) argument. They say deficits don't matter because we can just print more dollars to pay the debt. And technically? They are right. We won't default. But the value of those dollars will collapse. So sure, you get paid back your $100, but that $100 only buys a pack of gum. That is the hidden default. That is why deficits matter - not because the checks bounce, but because the money shrinks.

What is the best hedge against fiscal dominance?

Historically? Things that cannot be printed. Gold, land, commodities, energy stocks. When the government prints fiat currency to solve debt problems, finite assets tend to reprice higher in those depreciating dollars. It's simply a denominator problem.

References

Disclaimer: I am a writer, not a financial advisor. This article is for informational purposes only and does not constitute financial advice. Consult a professional before making investment decisions.